I hope you’ll forgive me for another newsletter about inflation. We are, unfortunately, stuck in a political moment where neither you nor I can escape the discourse on prices — and wages.

In past newsletter issues, I’ve made the point that our current rise in inflation is supply driven, i.e. that it results from shortages of certain goods, namely oil, gas, food staples, etc. Supply chains, disrupted during the pandemic, aren’t fully restored. Moreover, corporate power in the latter sectors has allowed firms to raise prices and even increase their profit margins, exacerbating the overall problem. All this is now well known, and more or less beyond refute.

The more hawkish economists and central bankers are calling for considerable interest rate increases to get inflation under control. In simple terms, they want to drive up unemployment and engineer an economic recession to slow wage growth. Sober analysts are, perhaps begrudgingly, also prescribing interest rate hikes to dampen demand, or to at least discipline workers’ expectations and demands for commensurate wage increases, albeit in a more measured and gradual way.

Whether central banks take an aggressive or gradual approach to monetary policy will matter for unemployment, but it likely won’t make much difference for inflation over the short-to-medium term. Again, we’re talking about supply-driven inflation that interest rate increases won’t affect.

But there’s an additional reason that interest rate hikes meant to “dampen demand” and restrain wage growth won’t bring inflation down: working-class institutions like unions are weak and those in power know it. This general and longstanding weakness has meant that workers’ have been less able to translate low unemployment into wage gains in the first place. Consequently, monetary policy directed at restraining wage demands is beating a dead horse.

The truly unfortunate part is that the decision to attack workers through monetary policy comes at a time when things are actually improving in the labour market, if slowly and unevenly. Raising interest rates, letting some of the air out of the economic recovery and loosening the momentarily tight labour market could very well undo these relatively favourable conditions.

Statistics Canada released the Labour Force Survey (LFS) for May 2022 last week. As has been the case for the last couple of months, the LFS has been largely positive. In May, unemployment was again down slightly to 5.1 per cent, an historic low point. Job growth was driven by full-time employment, and more evenly spread across age groups. Importantly, wage growth was noticeably up as well. Average hourly wages rose by 3.9 per cent. Those in full-time work saw a 4.5 per cent year-over-year hourly wage increase. Of course, average real wages were down because inflation continues to outstrip nominal pay increases.

Beyond the relatively good news reported in the past few monthly LFSs, there are signs that, over the longer term, the labour market is generally improving. Last month, Statistics Canada released a set of data covering various indicators of “quality of employment” in Canada. On the whole, many of these findings were positive.

Job tenure — a key measure of precarious employment — is improving. Whereas during the '90s, uncertainty concerning one’s length of employment became more widespread, and a higher proportion of workers were holding jobs of short duration, this trend has now been somewhat reversed. The share of people in long-term employment of 10 years or more has grown, while the proportion of workers in jobs for less than one year has shrunk. As well, the share of employees working long hours (49 or more in a week) has declined appreciably since the '90s, and is now roughly 8 per cent. The major exception to these positive signs, of course, is private sector union density, which continues its troubling downward trend.

The challenge remains how to translate a more favourable labour market into greater union density and working-class power. The challenge, however, may become moot if interest rate hikes loosen the labour market. The lack of strong working-class institutions is both an indication that workers’ wage demands haven’t contributed to current inflationary price growth and that workers will be far less protected from the short-term consequences of higher interest rates.

The unfortunate reality is that bosses and their representatives in government largely won the class war back in the '80s. Honest policymakers and central bankers know this, and many celebrate it. They realize that workers’ bargaining power, even in a relatively tight labour market, is limited compared to the inflationary '70s. Unions are unlikely to translate current labour market tightness into major wage gains at bargaining tables, though some recent victories are worth celebrating.

For example, as the OECD’s Economic Outlook for 2022 notes, with more than a whiff of celebration, “Changes in labour market institutions since the 1970s have reduced the risk that an oil price shock (or other negative supply shock) results in a wage-price spiral. The coverage of collective bargaining agreements has declined, many automatic wage indexation mechanisms have been removed, and lower union membership has reduced employees’ bargaining power.”

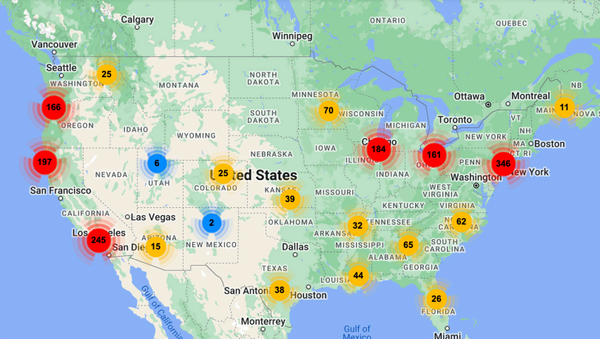

Additionally, researchers at the Federal Reserve Bank in the United States are making more or less the same point. According to David Ratner and Jae Sim, workers’ weak bargaining power explains the “missing inflation” during previous economic recoveries. After the Great Financial Crisis of 2009 and the subsequent economic recovery, job and wage growth were minimal and there were no signs of any uptick in prices typical of recoveries following deep recessions.

According to these researchers, previous labour market policy reforms that destroyed the bargaining power of the working class decoupled the relationship between the employment level and inflation. Class conflict and the balance of class forces, they contend, has determined price levels, not monetary policy. (Note: it’s truly remarkable to see this argument coming from researchers at the Fed!)

As one example here in Canada, consider the case of union “cost-of-living adjustment” (COLA) clauses in collective agreements. COLA clauses would typically force an employer to make upward wage adjustments during the life of a union contract if inflation reached some specified percentage. The number of major union collective bargaining agreements containing a COLA clause to anchor wages to inflation has declined dramatically since the early '80s. In fact, COLAs are almost extinct at this point. Even among union contracts that still contain a COLA clause, the wage protections against inflation are frequently quite weak. For example, it’s common for wage adjustments to only kick in when inflation reaches a very high level (10 per cent or higher isn’t out of the ordinary).

If the relationship between (un)employment and inflation was in fact killed years ago

Member discussion